Measures for inappropriate trading behaviors

As a Digital Exchange Operator, our ultimate goal is to ensure that we shall provide the integrity, fairness, and stability of the market, in order to protect investors, and promote ethical conduct among market participants. We, Gulf Binance Co., Ltd., therefore, enhance the level of supervision on digital asset trading activities through the development of inappropriate trading behavior guidelines which describe common and standard improper behaviors that are typically found.

It is important to note that engaging in other activities with bad faith intention of affect the overall state of digital asset trading, whether it leads to changes or not, may also be regarded as a violation of laws and regulations and could result in legal violations under the Emergency decree on Digital Asset Businesses B.E. 2561 and SEC Announcements GorThor 19/2561 re. Rules, Conditions and Procedures of Digital Asset Businesses.

Furthermore, we have established the measurements aimed at deterring recurrent inappropriate trading behaviors and adhering to the essence of legislation. These measurements consider various relevant factors, including but not limited to, the frequency of such behavior and the intention of influencing the price of digital assets. The levels of measurements are set as follows:

| |

| Notification letter, to inform our clients that their behaviors which lead to market abuse and request them to cease such behaviors |

| Warning Letter, to warn our clients about their behavior which could result in market manipulation |

| Warning Letter and Trading suspension for 1 day |

| Warning Letter and Trading suspension for 7 days |

However, for a client who clearly exhibits inappropriate trading behaviors which significantly affect trading conditions, stringent corrective measures could be implemented immediately without the need of any warning or notification.

The above measures will be effective on 14 November 2023, onwards.

Example of inappropriate trading behaviors

Wash Trade/ Matched Order

| |

| To mislead other investors regarding the price or trading volume in that digital asset. |

| A trader executes both buying and selling orders for an asset at the same time, giving the illusion of active trading while maintaining the same ownership position. This tactic can artificially boost trading volume and draw the attention of other investors. |

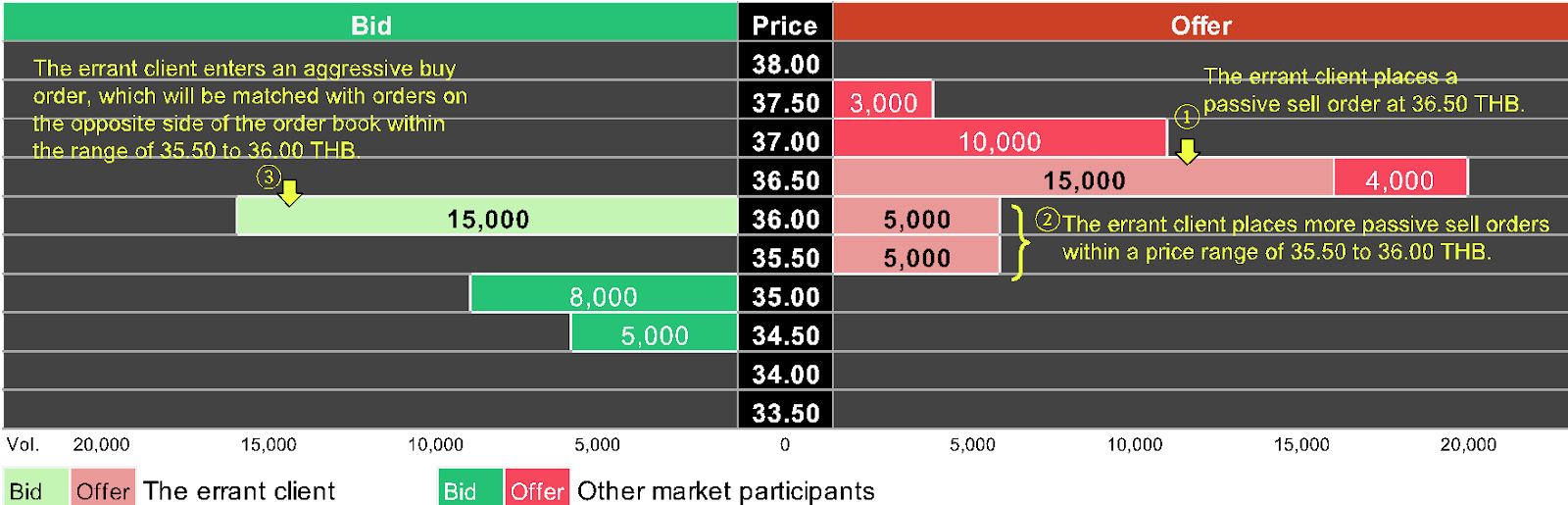

Case Illustration: Example of wash trade behavior

| |

| The errant client places a passive sell order at 36.50 THB |

| The errant client continually places more passive sell orders with a price range 35.50 to 36.00 THB |

| Suddenly, the errant client enters an aggressive buy order which will be matched with orders on the opposite side of the order book within the range of 35.50 to 36.00 THB |

| Then, other market participants follow by submitting an aggressive buy order, resulting in a match with the errant client’s sell order at the target price (36.50 THB). |

Last executed price 35.00 → 36.00 THB

![]()

Last executed price = 36.50 THB

![]()

Momentum Ignition/Price Ramp

| |

| To create a false impression among other investors that there has been a substantial alteration in the price of digital assets during a particular time. |

| Placing aggressive buy (sell) orders or continually being matched with the total best offer (bid) volume in either order book, resulting in substantial price fluctuations from the last trade price i.e., approximately around a +/- 10 spread/10%. |

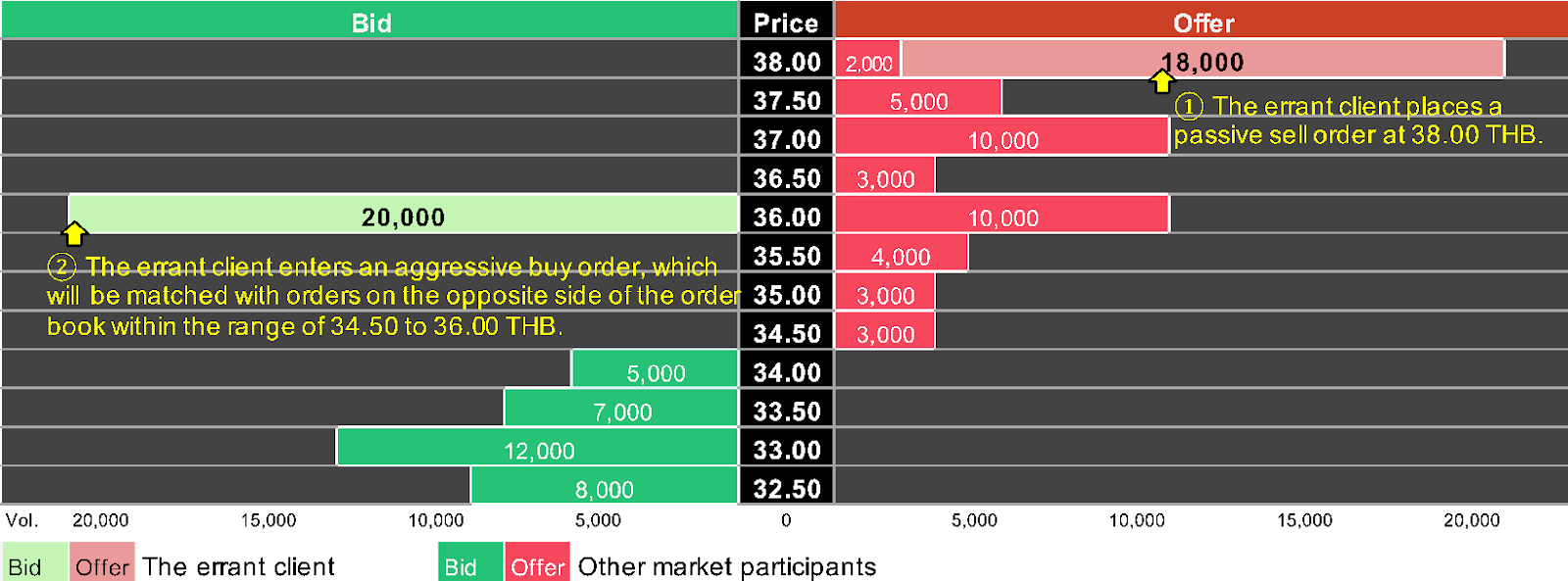

Case Illustration: Example of Momentum Ignition/Price Ramp behavior

| |

| The errant client places a passive sell order at 38.00 THB |

| The errant client suddenly enters an aggressive buy order which will be matched with orders on the opposite side of order book within the range of 34.50 to 36.00 THB |

| Subsequently, other market participants place multiple layers of buy orders. |

| The errant client initiates an aggressive buy order and continually matches with the several layers of the orderbook. |

| After that, other market participants follow by placing several buy orders, resulting in a match with errant client’s sell order at the specified price (38.00 THB). |

Last executed price 34.50 → 36.00 THB

![]()

Last executed price 36.50 → 38.00 THB

![]()

Last executed price = 38.00 THB

![]()

Spoofing

| |

| To deceive other investors into believing that there is a significant level of bid (offer) volume at a specific moment and to manipulate other participants into trading the target digital asset. |

| Enters a non-bonafide order to create an impression of an intention to trade but subsequently cancels these spoof orders and trades a bonafide order on the other side at a more advantageous price. |

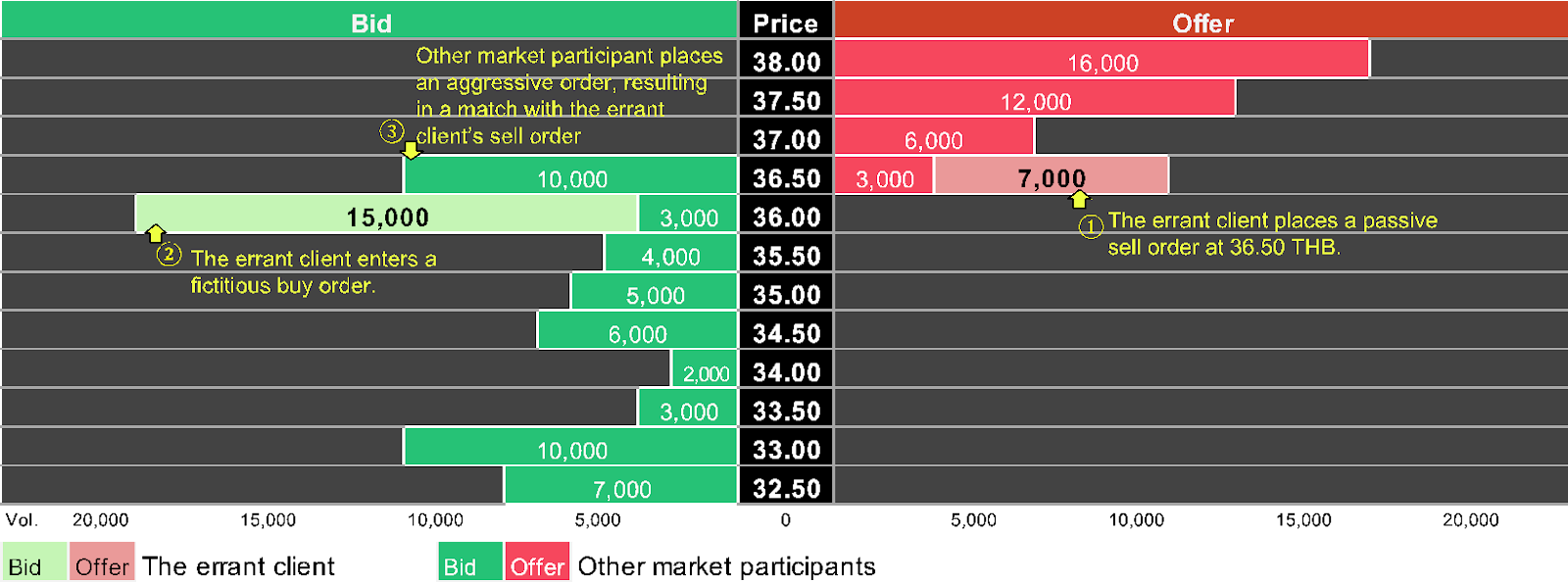

Case Illustration: Example of Spoofing behavior

| |

| The errant client places a passive sell order at 36.50 THB |

| The errant client enters a significantly volume of fictitious buy order to induce other market participants into reacting to false buy volume information |

| The other market participant places an aggressive buy order, resulting in a match with the errant client’s sell order. |

| After that, the errant client quickly cancels the fictitious buy order. |

Last executed price 36.00 → 36.50 THB

![]()

Last executed price = 36.50 THB

![]()

Layering

| |

| To deceive other investors into believing that there is a significant level of bid (offer) volume at a specific moment and to manipulate other participants into trading the target digital asset. |

| Enters non-bonafide orders at multiple price levels in order to increase the perception of liquidity on one side, resulting in a price move. |

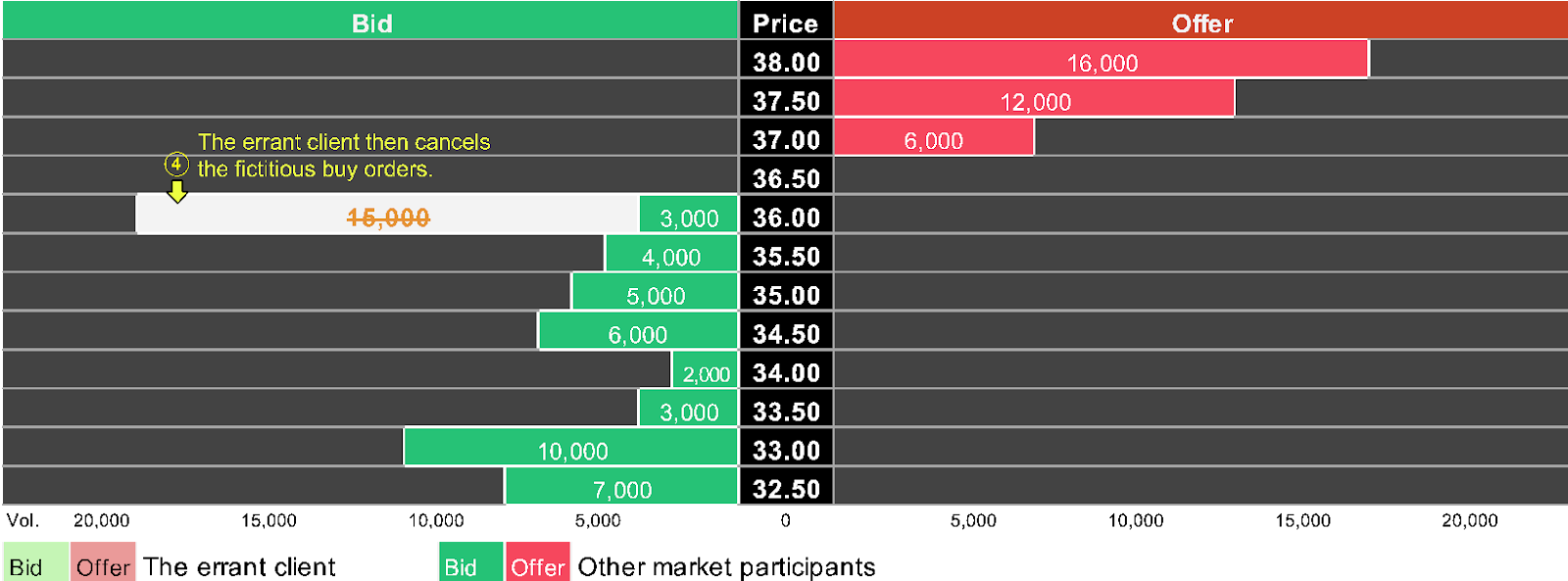

Case Illustration: Example of Layering behavior

| |

| The errant client places a passive sell order at 36.50 THB |

| The errant client then enters massive fictitious buy orders to induce other market participants into reacting to false buy volume information |

| Subsequently, the other market participant enters an aggressive buy order, resulting in a match with the errant client’s sell order. |

| After that, the errant client quickly cancels the fictitious buy orders. |

Last executed price = 36.00 THB

![]()

Last executed price 36.00 → 36.50 THB

![]()

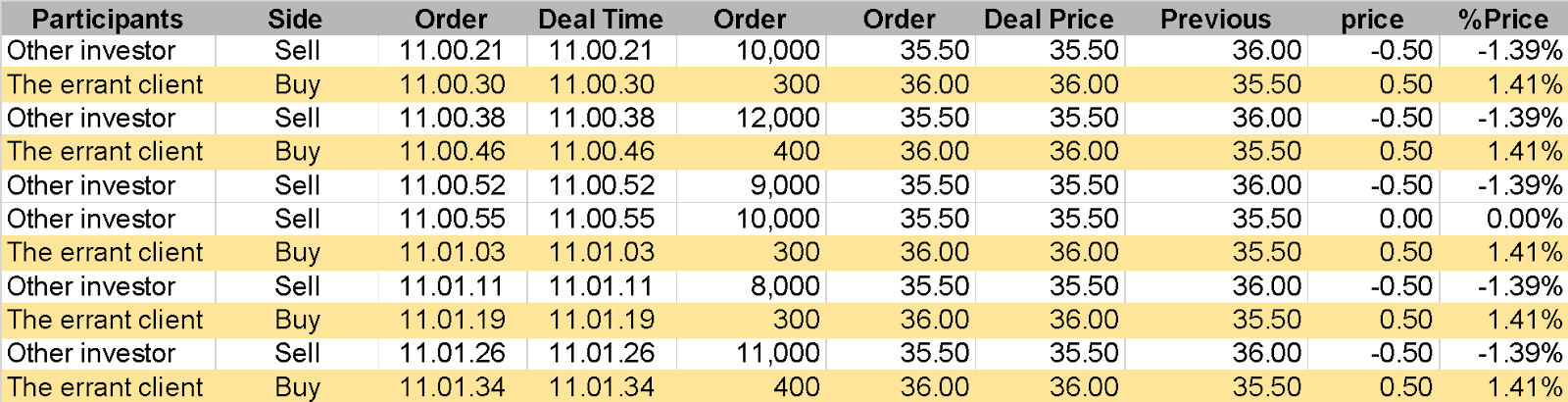

Maintaining the price

| |

| To control the price of digital assets |

| Splitting order with the intention to control the price of the digital asset i.e aggressive buy with a small order once the last executed price is reduced. |

![]()

![A graph with yellow dots and numbers

Description automatically generated]()