What are Market Order and Limit Order, and How to Place Them

There are two main types of orders when trading cryptocurrencies: market orders and limit orders. A market order is an instruction to buy or sell an asset immediately (at the market’s current price), while a limit order is an instruction to wait until the price hits a specific or better price before being executed. Let’s see how they work and how to place them on Binance TH

What is a market order?

A market order is executed at the current market price as quickly as possible when a user places the order.

When placing a market order, you can select [Amount] or [Total] to buy or sell.

For example, [Amount] is recommended when you want to buy or sell BTC with a certain quantity. However, if you wish to buy BTC with a certain amount of funds, such as 10,000 USDT, placing a market order with [Total] is a better option.

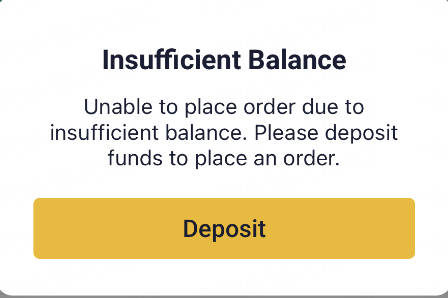

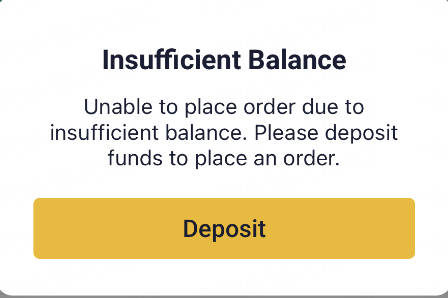

In general, you can use both functions to place your buy and sell orders. However, when you place the order after the system calculates the amount you can get, the asset price might have changed significantly, and the assets you will receive might be slightly different than the calculated amount before the order is placed. Under some circumstances, the order would fail. This often occurs when the buy/sell ratio is close to or equal to 100%.

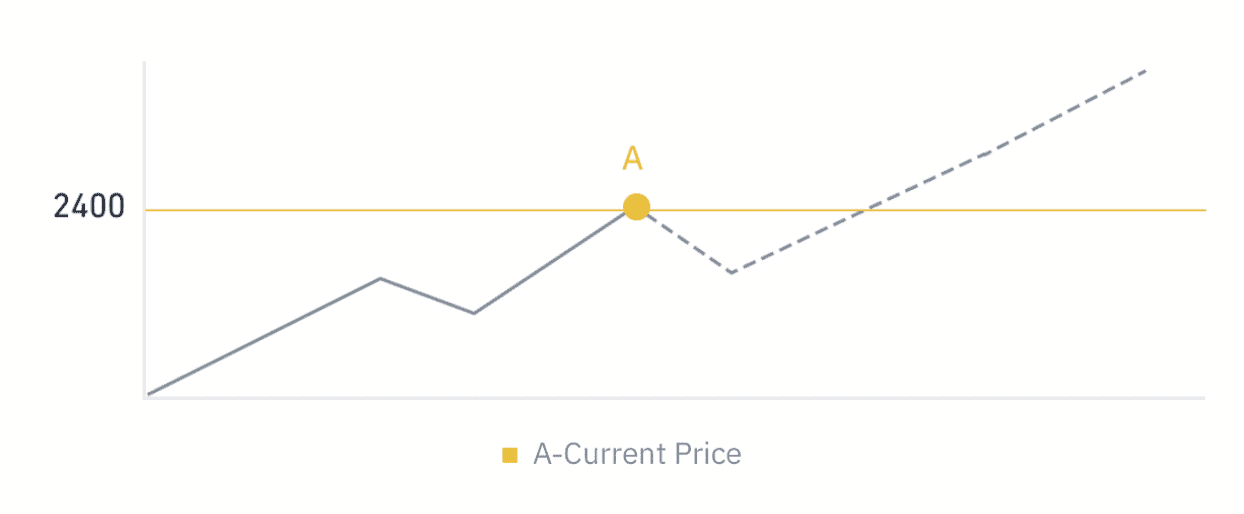

Market order example

The current price is 2,400. If you place a market order, your order will be filled with the best available price on the order book immediately. The average filled price of your order may not be exactly 2,400 (A); it could be slightly below or above 2,400.

How to place market buy orders?

1. By Total

Suppose you own 1,000 USDT and want to place a market order for BTC/USDT. When you place a “Buy 100%” order, the system will execute your order at the current market price according to the amount of USDT you have, but it is uncertain how many BTC you can buy. The final BTC transaction amount is determined by the market price and quantity when the order is placed. You can check the amount of BTC purchased and the average price from [Order History].

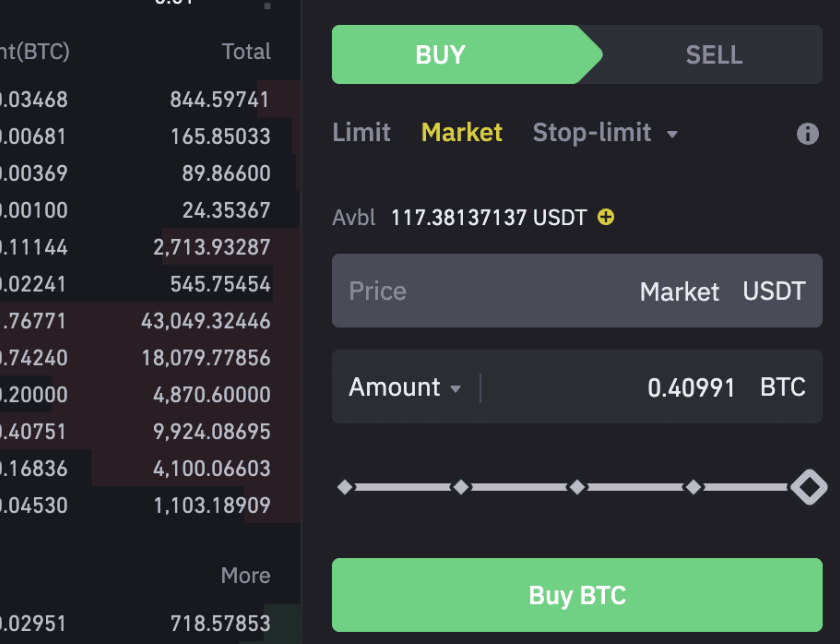

2. By Amount

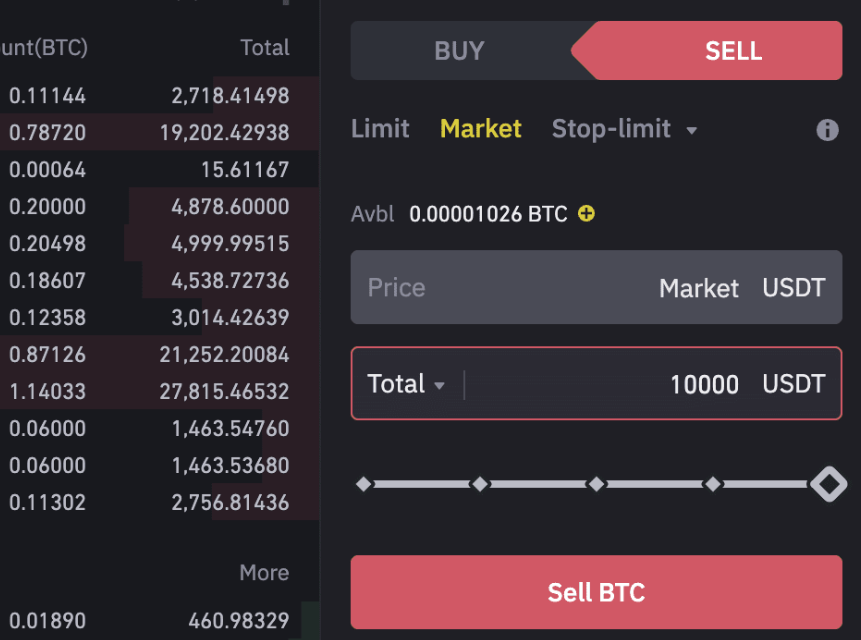

For example, you own 10,000 USDT, and the price of BTC/USDT fluctuates around 23,310.94 USDT. When you place a “Buy 100%” order, the system will match your order with the best available sell order(s) on the market to determine how many BTC you can buy.

If the system calculates that you can buy 0.40991 BTC with 10,000 USDT and you input 0.40991 BTC and click [Buy BTC], but at the same time, the BTC price increases, then 10,000 USDT can no longer buy 0.40991 BTC and your order will fail. You can place another order by manually editing the BTC amount you wish to purchase., Alternatively, you can use the [Total] function to buy your desired BTC amount.

How to place market sell orders?

1. By Amount

Suppose you own 0.40991 BTC and want to sell 100% with a market order. When you place the order, the amount of USDT from selling 0.40991 BTC will be determined by the current market price. You can check the amount of USDT obtained from the order and the average selling price from [Order History].

2. By Total

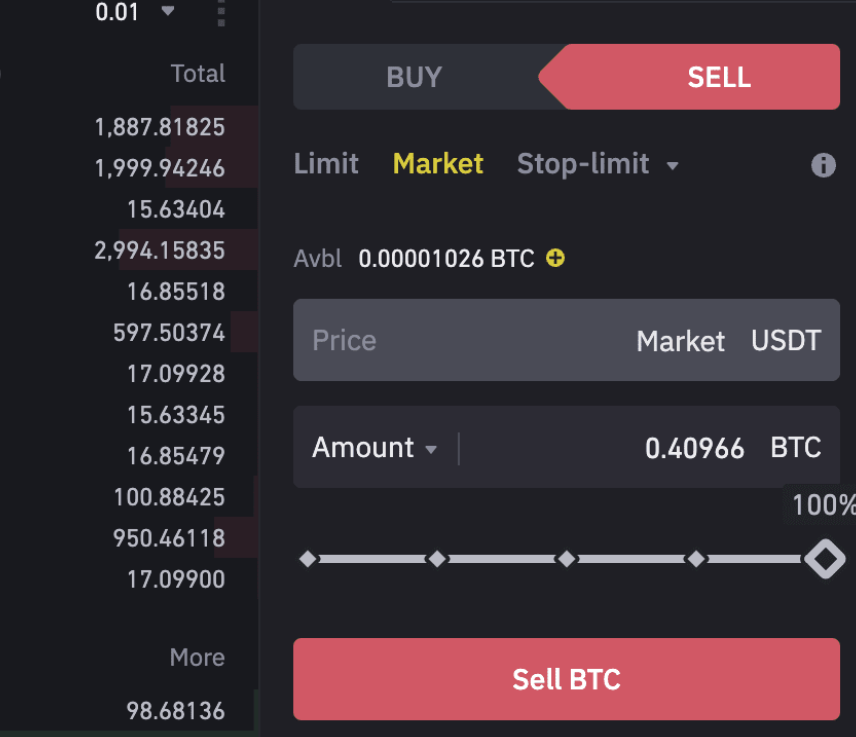

For example, you own 0.40966 BTC, and the price of BTC/USDT is fluctuating around 23310.94 USDT. When you place a “Sell 100%” order, the system will match your order with the best available buy order(s) on the market to determine how much USDT you can obtain.

If the system calculates that you can sell 0.40966 BTC for 10,000 USDT and you input 10,000 USDT and click to place the sell order, but at the same time BTC price drops, then 0.40966 BTC can no longer sell for 10,000 USDT and your order will fail. You can place another order by manually editing the amount of USDT you wish to receive. Alternatively, you can use [Amount] instead of [Total] to place your market order.

Frequently asked questions about Market Orders and Order Book Depth

Market orders are an integral part of cryptocurrency trading. They allow you to buy or sell an asset at the current market price, providing a straightforward and rapid way to execute your trade. However, it's important to be aware of how market orders interact with order book depth.

Order book depth, representing the current supply and demand in the market, plays a vital role in the execution of market orders. Here's a key point to remember: The execution of a market order is contingent on the availability of orders in the order book.

In situations where order book depth is insufficient, not all of your market order may be filled. When there's limited liquidity or significant price fluctuations, your market order could be partially executed, with any remaining portion being canceled. This can result in an incomplete transaction.

To maximize the effectiveness of your market orders, especially for substantial trades, it's wise to monitor market conditions and the order book depth closely. Additionally, considering the use of limit orders with specific price points can provide more control over your trading activities. Understanding these dynamics is essential for making the most of market orders on our platform.

What is a limit order?

A limit order is an order you place on the order book with a specific limit price. It will only be executed if the market price reaches your limit price (or better). You may use limit orders to buy an asset at a lower price or sell at a higher price than the current market price.

Limit order examples

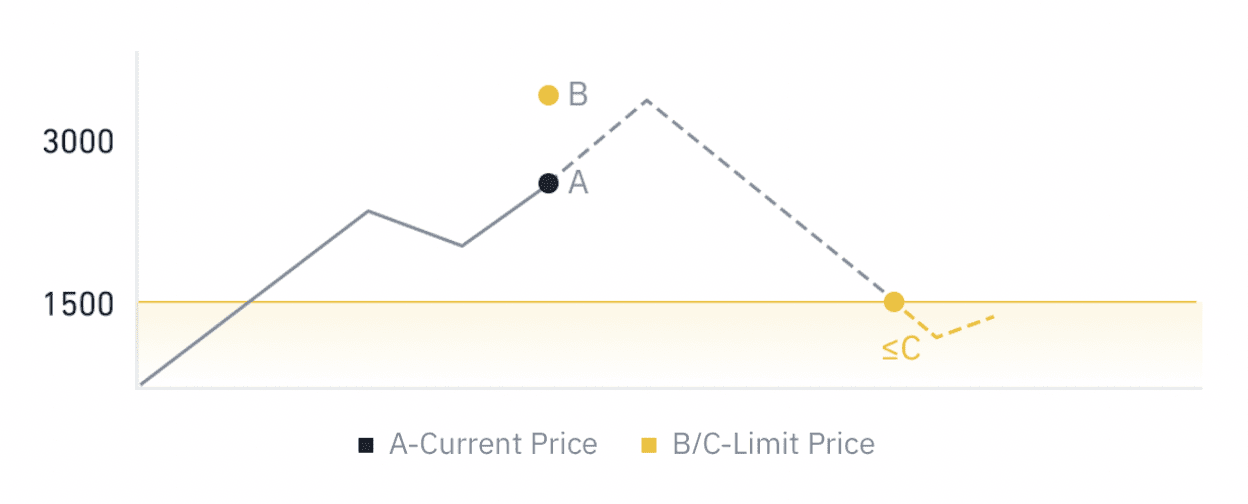

Buy order

When you place a buy order with a limit price (C) below the current price (A), and the current price (A) drops to the order’s limit price (C) or below, the order will be executed. When users place a buy order with a limit price(B) above or equal to current price (A), the order will instantly be filled around the current price.

For example, the current price is 2,400 (A). If you place a buy limit order with a limit price of 1,500 (C), the order will not be executed until the price drops to 1,500 (C) or below. If you place a buy limit order with a limit price of 3,000 (B), which is above the current price, the order will be filled immediately and the executed price will be around 2,400 but not 3,000.

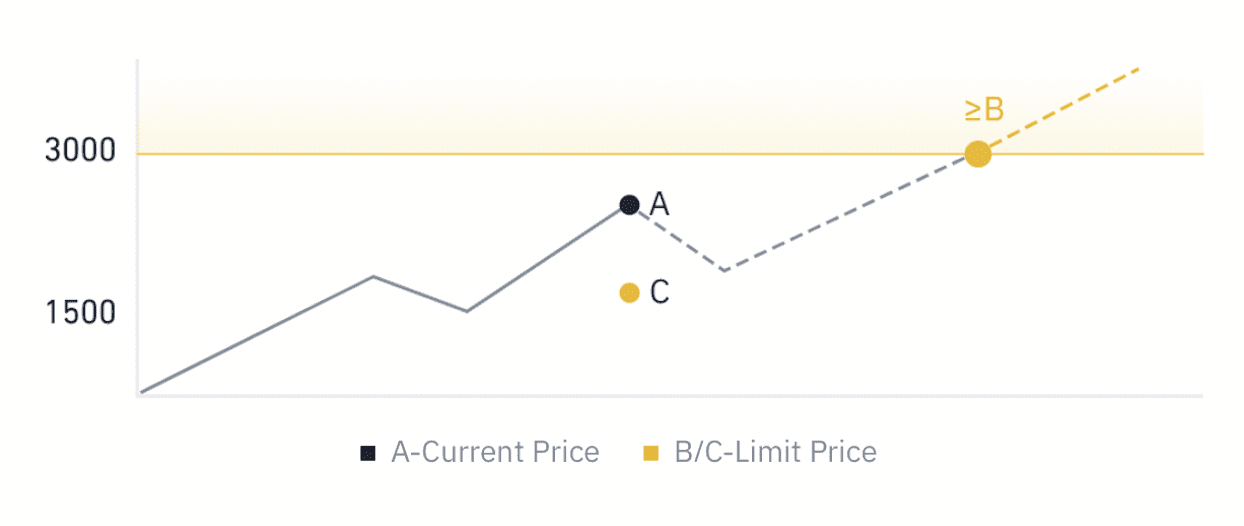

Sell order

When you place a sell order with a limit price(B) above the current price(A) and the current price (A) reaches the order’s limit price (B) or above, the order will be executed. When you place a sell order with a limit price(C) below or equal to the current price(A), the order will be filled immediately around the current price.

For example, the current price is 2,400 (A) and you place a sell limit order with a limit price of 3,000 (B). The order will not be executed until the price reaches 3,000 (B) or above. If you place a sell limit order with a limit price of 1,500 (C), which is below the current price, the order would be filled immediately at around 2,400 but not 1,500.

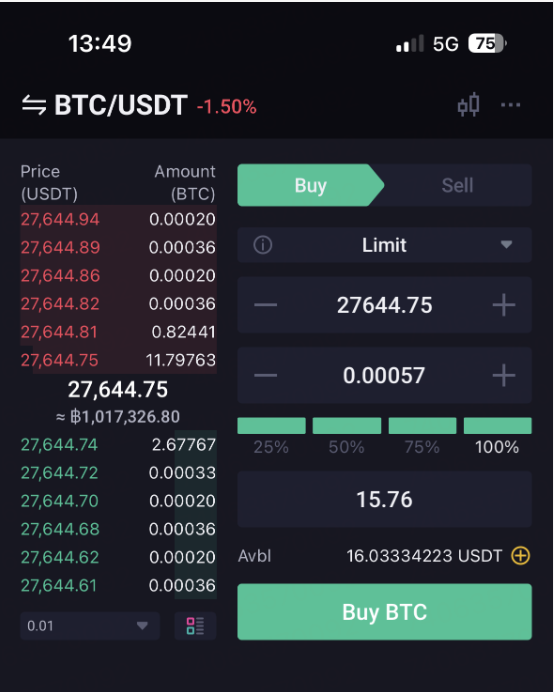

How to place a buy limit order?

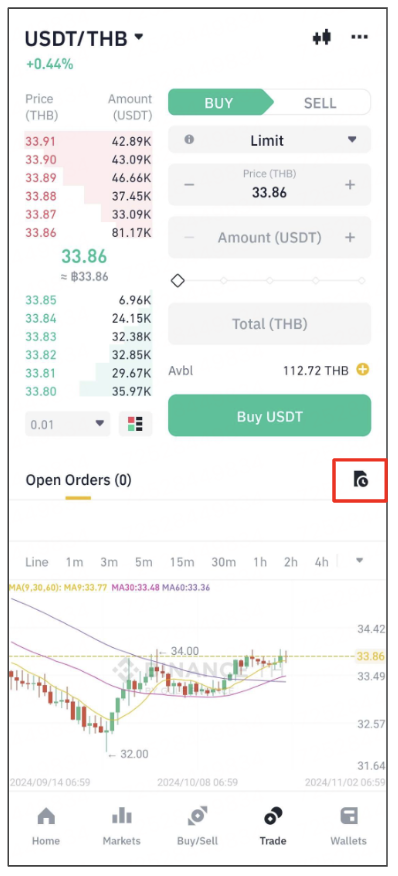

1. Click [Trade] - [Spot] and select the trading pair. Go to the [Spot] box and click [Buy] - [Limit].

2. Enter the price you want to buy. For example, you want to buy BTC at 24,3363.08 USDT.

3. You can enter the amount of BTC to buy directly next to [Amount].

Alternatively, drag the bar above [Total] to customize the percentage of the Spot Wallet balance to use for the order. For example, you own 10,000 USDT and you want to use 100% of it to buy BTC. Drag the bar to 100% and the system will automatically calculate the amount of BTC you can get with the limit order.

4. Click [Buy BTC] to place the limit buy order. Once the market price reaches your limit price (or better), your limit order will be executed.

How to place a sell limit order?

1. Click [Trade] - [Spot] and select the trading pair. Go to the [Spot] box and click [Sell] - [Limit].

2. Enter the price you want to sell. For example, you want to sell BTC at 24,363.08 USDT.

3. You can enter the amount of BTC to sell directly next to [Amount].

Alternatively, drag the bar above [Total] to customize the percentage of BTC to sell. For example, you own 0.41045 BTC and you want to sell 100% of it. Drag the bar to 100% and the system will automatically calculate the amount of USDT you can get with the limit order.

4. Click [Sell BTC] to place the sell limit order. Once the market price reaches your limit price (or better), your limit order will be executed.

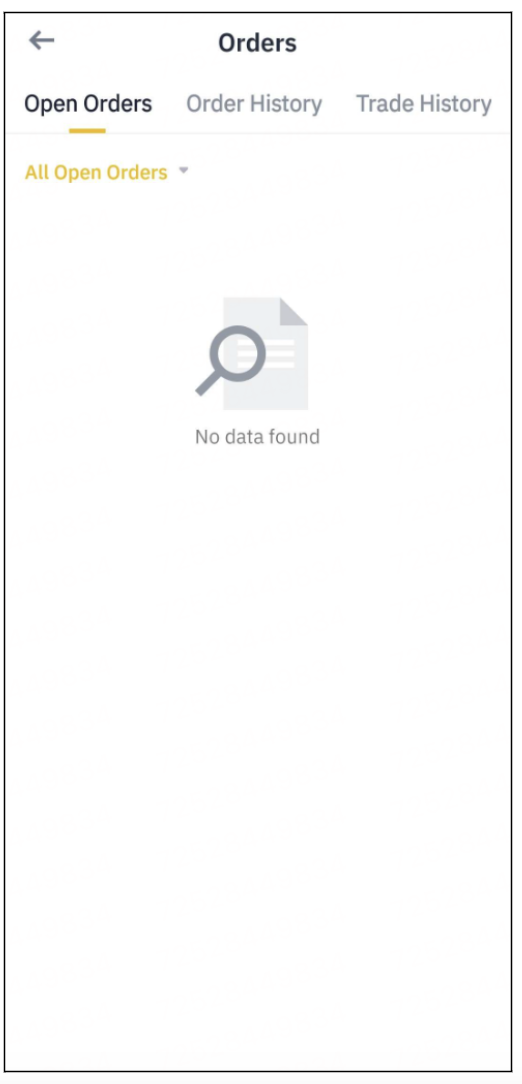

How to view my order history?

If you are using the Binance TH Website:

You can view your open orders under [Open Orders]. To cancel an order, click on the bin icon next to it.

You can check your filled orders under [Trade History].

If you are using the Binance TH App:

Go to [Trade] ,you can check your open order under the [Open Orders] tab and your filled orders under [Trades History].